Overview of Corporate Governance Structure

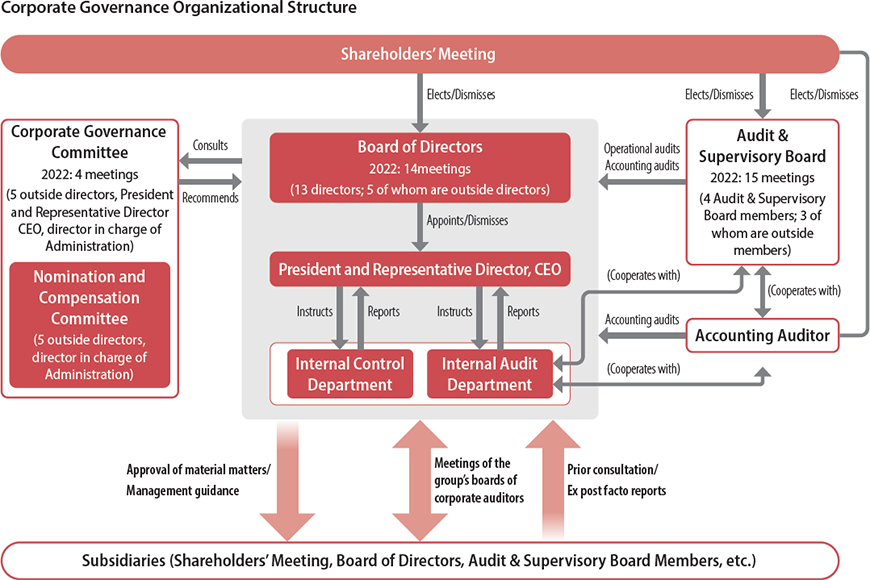

The Company has adopted the audit and supervisory board structure defined by the Companies Act, and as such has a Board of Directors and an Audit & Supervisory Board. It has also engaged an accounting auditor. Furthermore, as an advisory body to the Board, the Company has established the Corporate Governance Committee, consisting of the president, the director in charge of administration, and all outside directors. The Committee makes reports on matters relating to corporate governance, including the nomination of directors and Audit & Supervisory Board members, and the remuneration system and remuneration standards for directors and Audit & Supervisory Board members.

The Articles of Incorporation stipulate that the number of directors shall not exceed 18, and that the number of Audit & Supervisory Board members shall not exceed five. The Company's corporate governance structure is illustrated in the diagram below.

Initiatives to Strengthen Corporate Governance

View all

| 2008 |

|

|---|---|

| 2010 |

|

| 2011 |

|

| 2013 |

|

| 2014 |

|

| 2015 |

|

| 2016 |

|

| 2017 |

|

| 2018 |

|

| 2019 |

|

| 2020 |

|

| 2021 |

|

| 2022 |

|

| 2023 |

|

| 2024 |

|

Reasoning behind Corporate Governance Structure

With the aim of promoting the sustainable growth of the Company and increasing corporate value over the medium to long term, the Board of Directors, which also includes outside directors, advances the execution of management plans, supervises the Company's management, and also assumes roles and responsibilities related to enhancing profitability and capital investment efficiency. The Company secures its soundness and has established a solid corporate governance structure that lives up to social expectations by ensuring that the Audit & Supervisory Board and its members, which are independent from the directors, can audit the directors' performance of their duties in collaboration with the accounting auditor, as well as the Internal Audit Department.

Directors and the Board of Directors

Guided by the Board of Directors Regulations, the Board of Directors convenes regularly (once a month) and holds extraordinary meetings as necessary to make important business decisions and supervise the execution of operations. As of June 30, 2024, there were 13 directors, five of these were outside directors. To clarify executive responsibilities for each fiscal year, the term of directors is set at one year.

Director Selection Criteria

The Company aims to become “an indispensable contributor to people's health worldwide” by targeting sustainable growth and enhanced corporate value over the medium to long term. Toward this aim, the Company works to ensure the overall diversity of directors, and appoints people with the insight, expertise, and experience needed to realize and maintain appropriate and effective corporate governance. For internal directors in particular, we comprehensively evaluate the experience, expertise, insight, and other attributes of candidates to ensure that they have the qualities needed to implement the group's corporate philosophy, Code of Business Ethics, and management strategies.

Major Matters Deliberated by the Board of Directors in 2023

| Category | Number of times deliberated | Major reports and discussions |

|---|---|---|

| Business performance and plan | 18 |

|

| Corporate governance | 46 |

|

| Sustainability | 2 |

|

| M&A and partnerships | 9 |

|

| Risk management | 10 |

|

| Financial strategy | 5 |

|

| IT | 1 |

|

Corporate Governance Committee

Otsuka Holdings has had a Corporate Governance Committee since February 2017, and as a subcommittee of that committee, a Nominating and Compensation Committee since April 2023.

As an advisory body to the Board of Directors, the committee discusses the state of corporate governance at the Company, succession plans for the President and other executives, the development of management human resources, and other management issues of the group, and submits reports to the Board of Directors as necessary. The committee consists of the president, the director in charge of administration, and all outside directors (five as of June 30, 2024 ). The president serves as the chair of the committee.

The Nomination and Compensation Committee, a subcommittee of the Corporate Governance Committee, is composed of the director in charge of administration and all five outside directors, and is selected mutually from among the outside directors. The Nomination and Compensation Committee deliberates on the following matters, and reports its deliberations and decisions to the Corporate Governance Committee, which in turn reports back to the Board of Directors.

Main Items Discussed by the Corporate Governance Committee

| Corporate governance in general |

|

|---|

Main Items Discussed by the Nominating and Compensation Committee

| Evaluation of the president | |

|---|---|

| Nominations | The appropriateness and fairness of matters relating to the appointment and dismissal of directors and Audit and Supervisory Board members |

| Remuneration | Matters related to evaluation and individual remuneration of directors, remuneration systems, levels, etc. |

Audit & Supervisory Board

Audit & Supervisory Board members attend and express opinions at meetings of the Board of Directors, and monitor the performance of duties of directors in terms of legal compliance and soundness of management through audits. As of June 30, 2024, there were four Audit & Supervisory Board members (including three outside members).

To ensure the effectiveness of auditing by Audit & Supervisory Board members, systems have been established by which Audit & Supervisory Board members can interview directors and employees about the status of business execution, review internal consultation documents and other important documents pertaining to business execution, and promptly receive reports on the execution of operations when requested. The Statutory Auditor’s Office has been established to assist the duties of Audit & Supervisory Board members.

It convenes meetings of the Audit & Supervisory Board and assists in the duties of Audit & Supervisory Board members independent of directors’ authority.

Internal Audit Department

The Company’s Internal Audit Department reports directly to the president. The department regularly conducts audits based on the Internal Audit Rules to verify that operations are being executed appropriately and efficiently with regard to the assets and business of the Company and its affiliated companies. The department submits audit reports to the president, directors, and Audit & Supervisory Board members. Where there is need for improvement, the department recommends remedial actions and later confirms their implementation, thereby contributing to the optimization of business execution. In addition, the Department cooperates with corporate auditors’ audits and accounting audits by sharing information and cooperating with them.

Internal Control Department

The Company views internal controls as an integral component of corporate governance that functions together with compliance and risk management, and has an Internal Control Department as the department in charge of compliance and risk management to improve the internal control system. The Internal Control Department promotes the Otsuka Group Global Code of Business Ethics and other Otsuka group global rules at Otsuka Holdings and its affiliated companies. It also works to establish and promote compliance programs and risk management programs at each company. The status of the establishment and operation of those programs is regularly reported to the Board of Directors, the Audit & Supervisory Board, and the Accounting Auditor.

The Internal Control Department handles internal controls regarding financial reporting by the Company and its affiliated companies. The department formulates rules and manuals pertaining to internal controls, provides training, and ensures that employees thoroughly understand operational rules. The department also works in cooperation with the Internal Audit Department to continuously monitor the status of operations. This is the basis of an internal control system under which management personnel can be reliably evaluated.

Accounting Auditor

Otsuka has concluded an audit contract with KPMG AZSA LLC to serve as our accounting auditor, and we receive accounting audits from a fair and unbiased standpoint.

Board Members

In order to establish an effective corporate governance structure that supports sustainable growth, the Company appoints individuals with wide-ranging business experience, advanced expertise in broad fields, and extensive knowledge, as directors and Audit & Supervisory Board members. The table below summarizes areas of experience and expertise of directors and Audit & Supervisory Board members.

For further information on each director and Audit & Supervisory Board member, including a skill matrix, reasons for nomination, and significant concurrent positions outside the Company, please see respective the Notice for the Calling of the Annual Shareholders' Meeting.

Evaluation of Effectiveness of Board of Directors

During January and February 2024, the Company conducted a questionnaire survey of all directors and Audit & Supervisory Board members.

Results of the survey were reviewed by a company attorney, and then considered and evaluated at the Board of Directors meeting in March 2024.

- (1)Composition of the Board of Directors

- (2)Each director’s understanding and knowledge of business fields and specific management strategies and plans

- (3)Cooperation with outside directors

- (4)Cooperation with the Audit & Supervisory Board

- (5)Operation of Board of Directors meetings

- (6)Governance-related matters

- Function of the Board of Directors in determining the direction of management strategy

- Monitoring of each business with respect to the execution of management strategy

- Understanding of the perspectives of major investors and stakeholders

- Risk management

- Cooperation and information sharing with each operating company

- (7)Support system for outside directors

- (8)Operation of the Corporate Governance Committee meetings (frequency, agenda, etc.)

- (9)Overall functioning of the Board of Directors from the perspective of effectiveness

Achieving Overall Optimization while Maintaining the Uniqueness of Each Operating Company Summary of discussions

All directors and Audit & Supervisory Board members submitted responses that the Board of Directors is sufficiently effective. Such issues as the need for further deliberations on the composition of the Board of Directors (skills, experience, and diversity), the best way for the Company as the holding company to fully collaborate and share information with the various business companies, and the strategy and orientation of the overall group in order to furthermore raise the level of governance were discussed. It was also confirmed that efforts to improve the operation of the Board of Directors and deepen deliberations on the medium- to long-term management strategy to generate synergies and maximize corporate value as a holding company would be maintained.

Status of Outside Officers

Outside Directors and Outside Audit & Supervisory Board Members

The role of outside directors is to strengthen the Board's governance function of supervising appropriate decision-making and business execution by providing effective advice from a neutral, objective standpoint based on their broad insight and wealth of experience. Outside directors also verify the status of the Internal Control Department as necessary, and strengthen and enhance oversight of management through their various activities at Board of Directors meetings.

The role of outside Audit & Supervisory Board members is to enhance management transparency and strengthen auditing functions. They audit operations from a neutral, objective standpoint based on their high level of insight in finance, accounting, legal affairs and management, and wealth of experience in business management. In striving to improve the effectiveness of audits by Audit & Supervisory Board members, outside Audit & Supervisory Board members also share information and exchange opinions as appropriate with relevant departments, including the Internal Audit Department, Internal Control Department, Administration Department, and Finance and Accounting Department, as well as the accounting auditor.

The Company believes that it appoints outside directors and outside Audit & Supervisory Board members whose independence is secured and who have extensive experience and a high level of insight in business management.

Standards for appointing outside directors and outside Audit & Supervisory Board members

When appointing outside directors and outside Audit & Supervisory Board members, the Company looks for individuals with a wealth of knowledge and extensive experience in a variety of fields. The Company requires that candidates have the ability to adequately exercise management oversight functions through fair and objective monitoring, supervision, and auditing of management from a neutral and objective viewpoint. The Company recognizes that one standard for ensuring neutrality and objectivity is independence from management, and therefore requires that candidates have no relationship with the Company that could lead to a conflict of interest with ordinary shareholders. The Independence Standards for Outside Directors are defined in our Corporate Governance Guidelines, and form the basis for judgments on the independence of outside directors. In addition, we require that they have not previously been engaged in the execution of operations at any Otsuka group companies. These standards also form the basis for judgments on the independence of outside Audit & Supervisory Board members.

Independence Standards for Outside Directors

The Company determines that an Outside Director is independent if none of the following applies:

- A person who is a relative within the second degree of kinship of an Outside Director is currently or has been in the past three fiscal years a managing director, executive officer, executive operating officer or important employee (each an Executive) of the Company or one or more of the Company's subsidiaries.

- A company to which an Outside Director belongs as an Executive has transactions with the Otsuka group of companies, in which the amount of such transactions in any fiscal year within the past three fiscal years exceeds two percent of consolidated revenue of either company.

- An Outside Director, as a legal, accounting or tax expert or as a consultant, has received remuneration exceeding five million yen per fiscal year directly from the Otsuka group (excluding remuneration as the Company's Outside Director) in any fiscal year within the past three years

- The amount of donations to a non-profit organization to which an Outside Director belongs as an Executive has exceeded 10 million yen in total for the past three fiscal years and such amount exceeds two percent of the income of such non-profit organization.

Mutual Cooperation Between Supervision/Audits by Outside Directors/Outside Audit & Supervisory Board Members, and Internal Audits, Audits by Audit & Supervisory Board Members and Accounting Audits, as Well as Relationships with the Internal Control Department

Mutual cooperation between outside directors and the Internal Audit Department is enhanced through regular exchanges of information (including information exchanges with the independent accounting auditor and the Internal Audit Department) and discussions on management by outside directors and Audit & Supervisory Board members.

The Company holds regular briefing sessions for outside directors and outside Audit & Supervisory Board members on such matters as the status of business operations and industry conditions. In addition, to deepen their understanding of the group's businesses, outside directors and outside Audit & Supervisory Board members are provided with explanations of group businesses and opportunities to visit manufacturing, R&D and other sites as appropriate.

Succession Plan

The Company continues to develop and implement executive human resource development programs to identify talented personnel early and systematically nurture next-generation management candidates equipped with the qualities and skills called on by the corporate philosophy. The status of these programs is regularly reported to the Board of Directors.

System to Ensure Appropriate Business Operations in the Corporate Group Comprising Otsuka Holdings and Its Subsidiaries

As a holding company whose role is to maximize the Otsuka group's corporate value, Otsuka Holdings has established a system to ensure appropriate business operations from the perspective of the group as a whole.

We have established a system for facilitating cooperation in the Otsuka group. Under this system, affiliated companies report to Otsuka Holdings as necessary regarding items specified in the Affiliated Company Management Regulations, and obtain approval on relevant important items.

Otsuka Holdings and its main subsidiaries have adopted an audit and supervisory board system and appointed Audit & Supervisory Board members, who audit the directors' performance of duties to increase their effectiveness. Audit & Supervisory Board members attend Board of Directors meetings as well as other important meetings, and monitor the performance of duties of directors in accordance with audit policies and audit plans. As a general rule, meetings of group companies' Audit & Supervisory Boards are held four times a year to share information, strengthen coordination, and report on each company's business conditions.

Additionally, the Internal Audit Department of Otsuka Holdings, pursuant to the Internal Audit Rules, supervises or conducts audits that also include affiliated companies. In this way, the Company has established a cross-company risk management system and compliance system that ensure appropriate business operations throughout the group.

Status of Risk Management System

To defend against potential risks relating to the performance of duties, Otsuka Holdings has established rules regarding risk management, provides thorough risk management training to all employees, and has established a risk management system. In the event of an unforeseen risk event, the Company will respond promptly, set up committees to manage each category of risk as needed, and establish a system to minimize the spread of damage.